Global Alternative Data Industry: Key Statistics and Insights in 2024-2032

Summary:

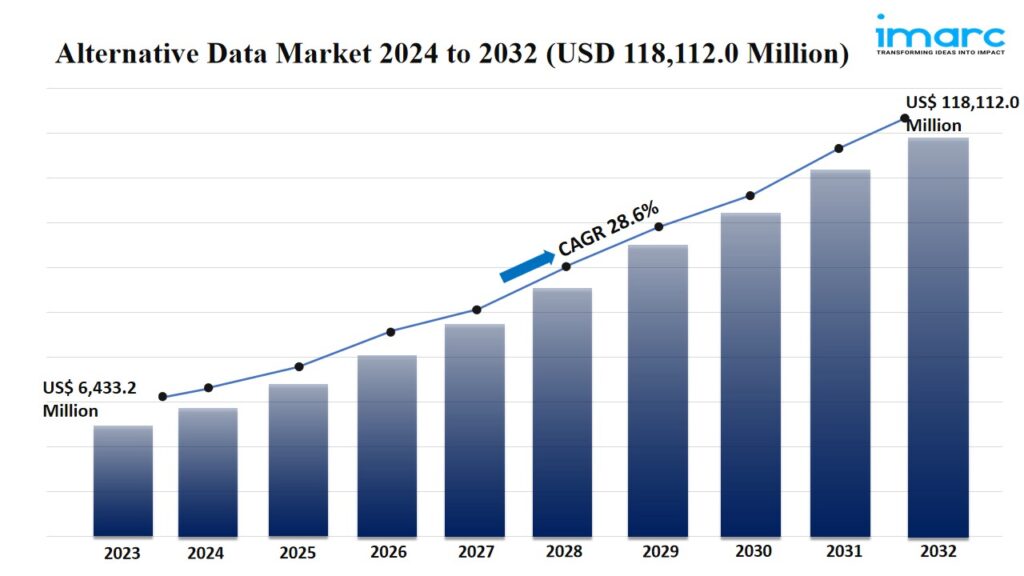

- The global alternative data market size reached USD 6,433.2 Million in 2023.

- The market is expected to reach USD 118,112.0 Million by 2032, exhibiting a growth rate (CAGR) of 28.6% during 2024-2032.

- North America leads the market, accounting for the largest alternative data market share.

- Credit and debit card transactions accounts for the majority of the market share in the data type segment due to the widespread adoption of digital payments and e-commerce.

- BFSI holds the largest share in the alternative data industry.

- The rising data availability is a primary driver of the alternative data market.

- Technological advancements and the demand for unique insights are reshaping the alternative data market.

Industry Trends and Drivers:

- Increasing data availability:

Governments, research institutions, and organizations are embracing open data initiatives, making vast amounts of data publicly available for analysis. These datasets cover areas, such as demographics, transportation, healthcare, environment, providing valuable insights for various industries, including finance. The proliferation of digital devices and online platforms is expanding digital footprints, generating vast amounts of data through interactions, transactions, and behaviors. This includes social media posts, online purchases, search queries, and mobile app usage, which can be leveraged for sentiment analysis, user preferences, and market sentiment.

- Demand for unique insights:

Alternative data offers investors a competitive advantage by providing access to non-traditional datasets that are not widely used by the broader market. These datasets can offer early indicators of market trends, user behavior, supply chain dynamics, and company performance, enabling investors to make informed decisions ahead of competitors. Alternative data also complements traditional fundamental and technical analysis by providing additional layers of information and context. By integrating alternative datasets with traditional sources of market information, investors can gain a more comprehensive understanding of market dynamics and make more informed investment decisions.

- Technological advances:

Innovations are leading to the development of sophisticated tools and techniques for collecting data from a wide range of sources. This includes web scraping tools, application programming interfaces (APIs), data crawlers, Internet of Things (IoT) devices, and satellite imagery platforms, which facilitate the collection of diverse datasets at scale. The rise of big data analytics is enabling organizations to process and analyze large volumes of data quickly and efficiently. Technologies, such as distributed computing frameworks, cloud computing platforms, and high-performance computing systems allow for the processing of massive datasets in parallel, unlocking insights that were previously inaccessible.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/alternative-data-market/requestsample

Alternative Data Market Report Segmentation:

Breakup By Data Type:

- Mobile Application Usage

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Satellite and Weather Data

- Social and Sentimental Data

- Web Scraped Data

- Web Traffic

- Others

Credit and debit card transactions represent the largest segment as they offer granular insights into consumer spending patterns and economic activity, which are highly valued by investors for making informed decisions.

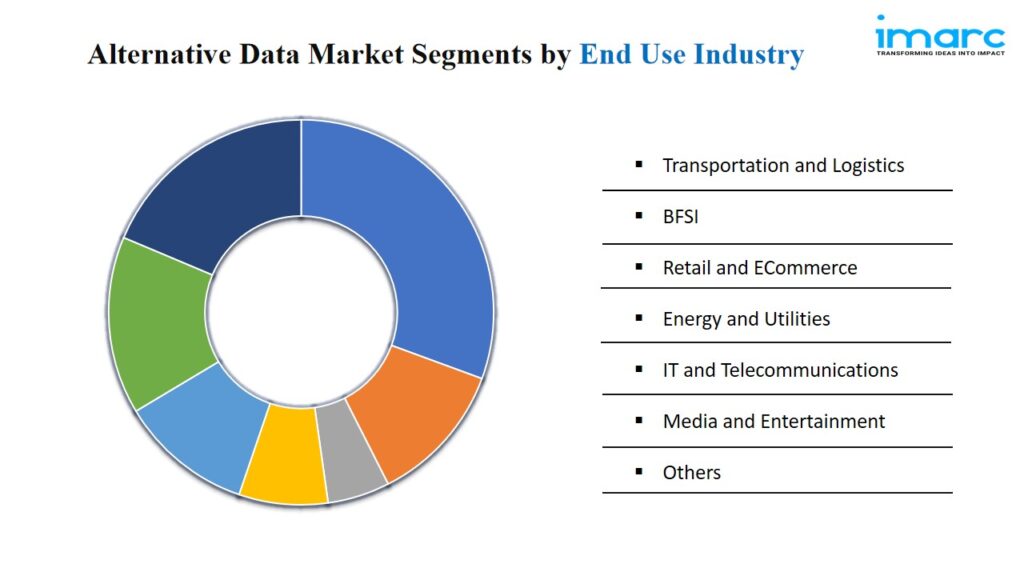

Breakup By End Use Industry:

- Transportation and Logistics

- BFSI

- Retail and E-Commerce

- Energy and Utilities

- IT and Telecommunications

- Media and Entertainment

- Others

BFSI accounts for the majority of the market share due to its reliance on data-driven insights for risk management, investment analysis, and regulatory compliance.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the alternative data market on account of its mature financial markets, strong technological infrastructure, and a high concentration of financial institutions and technology companies actively investing in alternative data solutions.

Top Alternative Data Market Leaders:

The alternative data market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- 1010Data Inc. (Advance Communication Corp.)

- Advan Research Corporation

- Dataminr Inc.

- Eagle Alpha

- M Science

- Nasdaq Inc.

- Preqin

- RavenPack

- The Earnest Research Company

- Thinknum Inc.

Note: If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145